Yes! Remittance has always been crucial to this region as dozens of foreigners work there and must send money back home every month. Interestingly, a massive move towards digitization and the region’s efforts to take a collaborative approach to evade the US Dollar is transforming the region’s remittance landscape.

Interestingly, a mode of transaction in many countries is cash-driven by the lack of banking services. It merged with COVID-19 outcomes, changing migration patterns & economic hurdles, and has paved the way for the fintechs’ growth in the region, ensuring more hassle-free methods of sending money.

Digitization of Southeast Asia

Indeed! This region deserves applause for moving towards digitization, revolutionizing every sector, and making people's lives easier, such as sending money from Singapore to Turkey, Pakistan, India, and Sri Lanka.

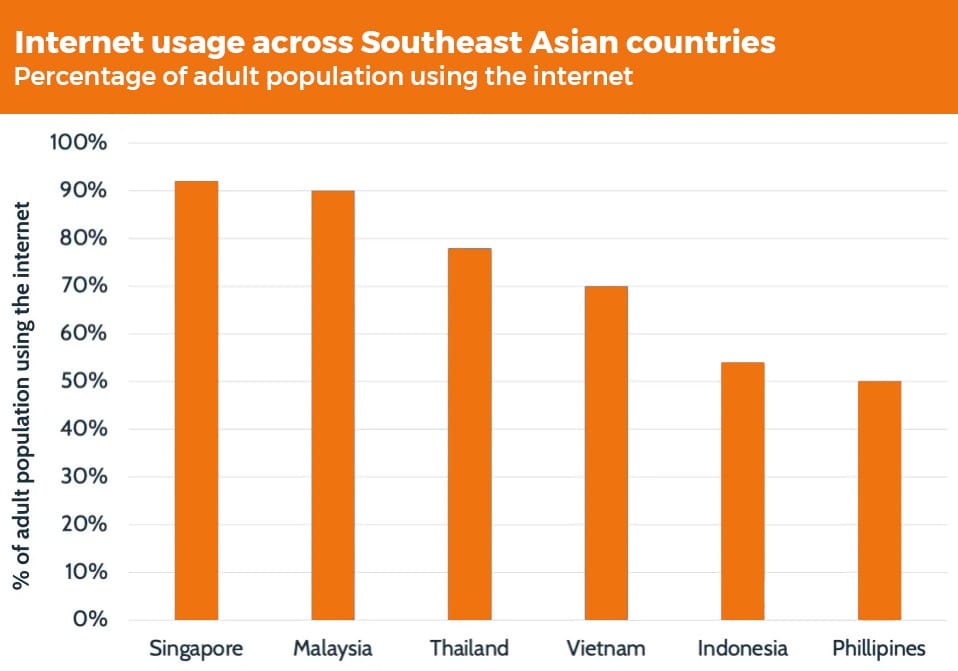

One of the indicators of people’s tilt toward the digitization of this specific region is Google’s report, manifesting over 460 million online users across significant economies such as Thailand, Singapore, Malaysia, Vietnam, the Philippines, and Indonesia.

Let’s Discern the Major Fund Transfer Players in Southeast Asia

;

;

The moment you begin digging out the region from the perspective of leading players in the remittance landscape, you come across many well-known names with all the possible money transfer options. Interestingly, most money transfer companies focus on Singapore, which is considered the hub of cross-border payments in the region; hence, many global fintechs, such as Speed Remit, prefer investing in the Singaporean remittance landscape.

Considering this rise in Singapore's remittance space, prominent names such as Speed Remit are improving their services with different products, including super practical conversion rates, and preparing for possible future challenges in the sector.

Fund Transfer Landscape’s Progress in The Last Few Years in Southeast Asia

According to the World Bank, remittance flow to this region dropped to 3.3% in 2021, following a 7.3% decline in 2020. However, apart from China, the region's remittance landscape improved by 2.5 % in 2021 and was projected to increase by 3.8% in 2022. Furthermore, the average expense of sending $200 to the region declined to 5.9% in Q4 2021 compared to 6.9% a year prior.

Challenges This Remittance Sector Faces in the Region

- High Fund Transfer Costs

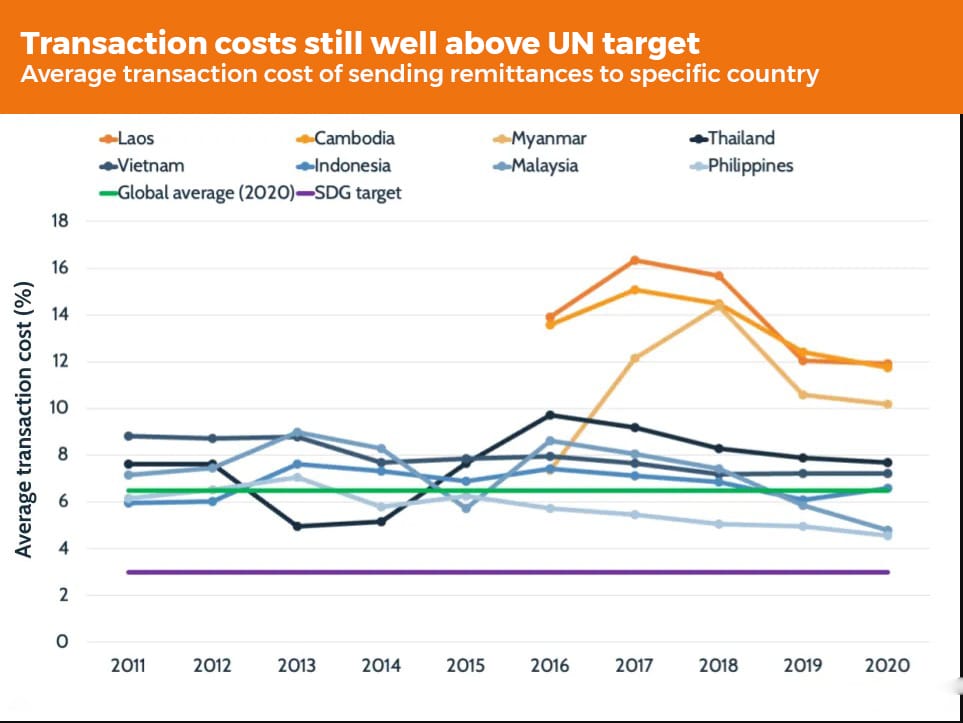

Massive transaction costs are a growing challenge for remittances. While examining this further, you discern that the international average fund transfer cost to send remittances was 6% in 2021, higher than the target of below 3% in the United Nations' Sustainable Development Goals.

- Hindrances in Timely Fund Transfers

It is also an essential concern in connection with fund transfers; hence, thriving companies have set up an entire department focused on ensuring timely remittances to recipients, making them exist among the region’s leading players in its remittance landscape.

As remittances are meant for different areas for different reasons, Thailand’s example fits this notion as it sees 84% of its outward remittances go to other Southeast Asian countries. A higher number of outward remittances is because of the massive influx of Myanmar immigrants who send money back to their country from Thailand.

Let’s Check Out Remittance Landscapes in Major Southeast Asian Countries

Singapore

While evaluating Singapore, you notice digital fund transfer is the most prominent mode of money transfer for people, with traditional bank transfers still intact in the country.

To become a digital currency country in the near future, Singapore has already taken measures such as developing easy digital payment systems and participating in the Association of Southeast Asian Nations cross-border payment linkage programs. These will definitely assist Singapore in putting cash behind and following the most advanced methods of payments and fund transfers.

Indonesia

Although traditionally cash-dependent, Indonesia is considered to be the leading country for a digital payment system. Encouraged by the youth's tendency towards smartphone usage, mobile wallets are on the rise in the country, paving the way for the country to stand alongside Singapore in the pursuit of becoming a digital currency country in Southeast Asia.

Malaysia

It is one of the fastest-growing countries in the region with the massive adaptation to technology, particularly in the area of remittance, and that can be gauged by the country’s massive growth in real-time payments back in 2019 and 2020. Interestingly, the number of these digital payments increased by 864% to 68 million, and this specific increase was because of the national program called DuitNow that enabled domestic transfers to & from mobile numbers.

Let’s Explore Money Transfer Trends in the Region

The Role of Immigration

Yes, the massive migration of people from developing countries to developed countries in the region is the leading driving force for huge fund transfers in the region. Furthermore, lots of Southeast Asian countries are on the World Bank’s list of low & middle-income countries, indicating ex-pats often search for employment that turns it into their next need, which is sending money back home.

Absence of Financial Inclusion

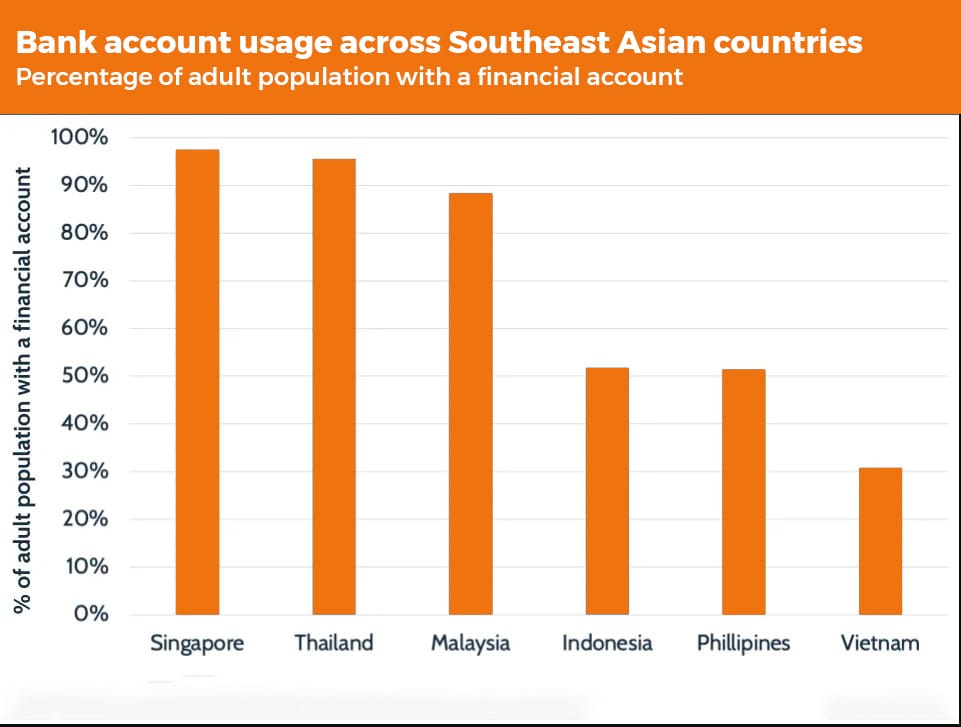

Financial incorporation -the availability & accessibility of financial services- is a mixed bag across Southeast Asia. On the one hand, more than 70% of Southeast Asia’s population has no bank accounts, preventing them from availing common financial facilities such as loans, credit cards and insurance.

On the other hand, in some countries, you rarely find anyone with not have a bank account; for instance, Singapore is known as the financially comprehensive market in the region, with 97.55% of adults owning bank accounts. Interestingly, it is one of the reasons why Singapore is more inclined to digital payment systems, evolving its remittance landscape and turning the country into a more progressive one digitally in the region.

A Tilt towards Mobile Money

Well, the growth of mobile money apps lies at the foundation of the accessibility of digital money payment, regulatory measures, and storage methods in the region. The GSMA states that across Southeast Asia, 68% population was digitally infused in the shape of massive reliance on the internet to accomplish routine matters in 2021.

Interestingly, putting cash dependency behind by Southeast Asian population not only makes ground for digital remittance but also brings competition among different online money transfer players in the region that, in return, will definitely decrease the cost of fund transfers.

Wrapping It Up

Having read this write-up, you will have concluded that the future of the fund transfer sphere of Southeast Asia looks to be led by further adaptation of digitalization, with new & mandatory players profiting from corporations with prominent money transfer companies.